Should You Shrink Your Space in Retirement? Pros and Cons to Weigh

Homes hold decades of stories—birthdays, holidays, everyday comfort. As retirement approaches, a hard question often surfaces: Is this still the right place for us?

Leaving can feel heavy, yet the pull of a simpler, less costly life is real. Maybe a smaller place would cut upkeep. Or perhaps a too-large home and remaining mortgage are squeezing your budget. The choice to downsize blends hard numbers with the emotions of closing one chapter and opening another. We regularly retirees through this decision; below is a clear, balanced framework you can use right now.

Key Takeaways

Downsizing can help—but it’s not automatic. Selling a long-time residence may unlock equity and lower monthly costs, yet you must factor in moving expenses, taxes, and the emotional work of leaving.

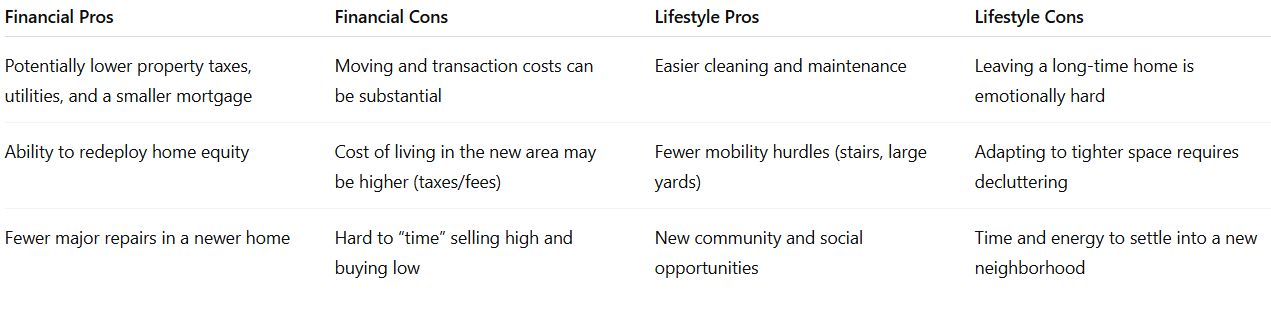

Consider both money and lifestyle. The biggest financial plus is converting home equity to cash, but timing the market is tricky and transaction costs add up. The main lifestyle plus is simplified living, though adapting to a smaller home and new community can be challenging.

Get professional eyes on the plan. Beyond square footage, you’ll want clarity on costs, potential property-tax changes, and how a move affects your long-term retirement strategy.

Why Many Retirees Consider a Smaller Home

Rising Costs of Staying Put

A large home can strain retirement income—even without a mortgage. Pressure points often include:

Property taxes and homeowner’s insurance that creep up

Utilities tied to greater square footage

Ongoing maintenance

Cosmetic updates for aging spaces

If you retire with a mortgage on more house than you need, the payment can pinch cash flow. Trading down can reduce or eliminate that monthly debt.

Lifestyle Shifts in Retirement

Once the kids move out, yesterday’s perfect family home can feel oversized. A smaller place can free time for what matters—travel, seeing family, volunteering. Other drivers:

Mobility considerations (fewer stairs, better access)

Moving nearer to family and friends

Gaining modern features without living through a remodel

Proximity to entertainment and healthcare

Housing Paths to Consider

Age in place: If you love the community, have no mortgage, and the layout fits your mobility needs, staying can be entirely sensible.

Downsize to a smaller single-family home: Aim for a place you can afford comfortably—ideally without a payment—and with less upkeep.

Shift to a condo or townhouse: Exterior maintenance and yardwork are typically handled; trade-offs include shared walls and higher HOA/community fees.

Live with family: Works when mobility support or multigenerational benefits are clear.

Explore a continuing care retirement community (CCRC): One campus that can accommodate independent living, assisted living, and skilled nursing as needs change.

The Financial Upside of Downsizing

Lower Monthly Outlay

Smaller homes typically mean lighter property taxes and utilities; a smaller yard simplifies landscaping.

Example: A family in a 3,000-sq-ft home in Westchester, New York may spend about $600/month for heating and cooling in peak seasons. By moving to 1,500 sq ft, that bill could drop to roughly $300/month.

Often the largest savings come from reducing or eliminating the mortgage. Using current equity to purchase a less expensive home can free budget space for healthcare, travel, and other goals.

Turn Home Equity into Flexibility

A major financial benefit is tapping accumulated equity. Since 2015, median U.S. home sale prices have climbed ~70%, making equity conversion attractive for many owners.

After buying a less expensive home, leftover proceeds can:

Bolster retirement savings

Fund big-ticket goals (travel, vehicle)

Increase reserves for emergencies and healthcare

Tax note: Under current IRS rules, you can generally exclude up to $250,000 of gain on the sale of a primary residence; married couples can exclude up to $500,000, assuming you’ve lived there 2 of the last 5 years.

Example: Purchase at $300,000, sell at $750,000 → $450,000 gain (before basis adjustments). For a married couple, that $450,000 would be fully excluded under current rules—leaving more equity for your next step or savings.

Fewer Surprise Repairs

A newer, smaller home can lower the odds of major replacements—roof, water heater, HVAC, windows, plumbing, electrical—reducing costly surprises and stress.

Lifestyle Advantages of a Smaller Place

Simplified Day-to-Day

Less space means less to clean and maintain. Downsizing also invites a healthy declutter: donate, sell, or gift items that no longer fit—and pass along heirlooms now if that feels right.

Age-Friendly Layouts and Locations

Single-level living, wider doorways, and easy-access utilities can make daily life smoother. Choosing a location nearer to shopping, entertainment, healthcare, or grandkids can be a real boost.

Built-In Community

Many retirement-oriented communities offer activities, dining options, and housekeeping—making it easier to stay social and supported.

The Financial Downsides to Watch

Moving and Transaction Expenses

It’s easy to underestimate the total:

Moving a 4–5 bedroom home long-distance can run ~$3,000

New furniture/décor for a different layout adds costs

Disposal fees for items you can’t donate

Buyer-requested repairs reduce your net proceeds

Real estate agent commissions up to 6% of the sale price

Closing costs on both sale and purchase may include legal fees, title work and insurance, loan origination, appraisal, and prorated taxes. Ask your agent for a detailed net sheet so you know what you’ll truly walk away with.

What Might Downsizing Really Cost?

Sell at $750,000 → up to 6% commission ($45,000)

Plus 2–5% closing costs ($15,000–$37,500)

Plus moving company (~$3,000)

Estimated total: $63,000–$85,500

Possibly Higher Ongoing Costs Elsewhere

Lower or no mortgage doesn’t guarantee lower total living costs. Depending on your destination, property taxes, sales taxes, or state income taxes can be higher. Retirement communities may include entrance fees, HOA dues, and monthly charges that increase over time—especially in CCRCs, where costs vary by level of care.

Market-Timing Realities

Selling high and buying low at the same time is rare. In a seller’s market, your sale price may shine but you face bidding wars for the next place. In a buyer’s market, you may score a good purchase while your sale underwhelms. To ground expectations, seek a professional appraisal and work with an agent experienced in your target area.

Emotional and Lifestyle Challenges

Saying Goodbye to a Memory-Rich Home

Attachment is real. Involving family in decisions—and in sorting keepsakes—can ease the transition.

Less Space, Less Privacy

Adjusting to fewer rooms and storage takes time, especially if you often host guests. Thoughtful decluttering and smart storage solutions help.

New Community, New Routines

Moving closer to family—especially out of state—means rebuilding a network: new doctors, friends, and favorite spots. Expect an adjustment period.

Downsizing: Quick Reference

How to Prepare for a Move

Create a Timeline

Start 6–12 months before your ideal move date. Research communities and ask a trusted local agent for a realistic valuation and net sheet.

Declutter Early

Begin with storage spaces (basement, attic). Ask: Do I use it? Is it sentimental? Will it fit? Invite family to claim items they want.

Plan the New Layout

Measure rooms and map essential furniture so move-in is smooth.

Get Professional Help

Lean on a financial planner and tax professional to validate the numbers and refine the game plan. Hire reputable movers to reduce physical strain and stress.

How to Decide If Downsizing Fits

Consider these questions with your advisor:

Does your current home still meet your physical and financial needs?

Do you want simplicity now, or do you value the extra space more?

Would being closer to amenities or family improve daily life?

Can you afford all moving and closing costs—expected and unexpected?

Does downsizing strengthen or weaken your long-term retirement plan?

Bottom Line: It’s More Than Square Footage

Downsizing is a major life choice that touches money, lifestyle, and emotions. There’s no universal answer. A thoughtful review of the pros and cons—with guidance from your financial and tax advisors—can help you make a decision that supports the retirement you want.

Want Personalized Help Deciding Whether to Downsize?

If you’re weighing a move to improve your retirement plan, FMD Wealth Advisors can help analyze the numbers, consider tax implications, and build a comprehensive strategy that includes your housing decision. We’ll help you budget for closing costs, coordinate with your tax professional, and, if helpful, connect you with a real estate agent. Schedule a complimentary intro call today.

Frequently Asked Questions (FAQs)

Should you downsize your home at retirement?

It can be a smart move when it improves both your finances and day-to-day life. Downsizing may free equity, reduce monthly expenses, and simplify living. Weigh that against transaction costs and the emotions tied to leaving your current home.

At what age do most people downsize their home?

There’s no fixed age. Most consider it when the home no longer fits their needs or when upkeep and mortgage costs strain retirement income.

Is there a downside to downsizing?

Yes. Expect real estate and moving costs, the possibility of higher expenses in a new area, and the emotional challenge of leaving. Smaller spaces also mean less room for guests and belongings.

When should a senior sell their home?

When you’re ready for a different lifestyle and understand the financial implications. Plan ahead and coordinate with a real estate agent, financial planner, and tax professional to choose timing that works for you.

What percentage of retirees downsize?

Many ultimately stay put; a recent Kiplinger piece notes the majority age in place rather than moving.

What is a continuing care retirement community?

A CCRC offers multiple levels of care—independent living, assisted living, and skilled nursing—within one community. If you’re exploring long-term care planning, include CCRCs in your research.

Disclosures: FMD Wealth Advisors LLC (“FMD Wealth Advisors”) is a Registered Investment Adviser.

This material is for general information only and is not individualized legal or tax advice. Consult your attorney and CPA regarding legal and tax matters specific to your circumstances. This content is intended to provide general information about FMD Wealth Advisors. It is not intended to offer or deliver investment advice in any way. Information regarding investment services is provided solely to gain an understanding of our investment philosophy, our strategies and to be able to contact us for further information.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Additional Important Disclosures may be found in the FMD Wealth Advisors Form ADV Part 2A. For a copy, please Click here.