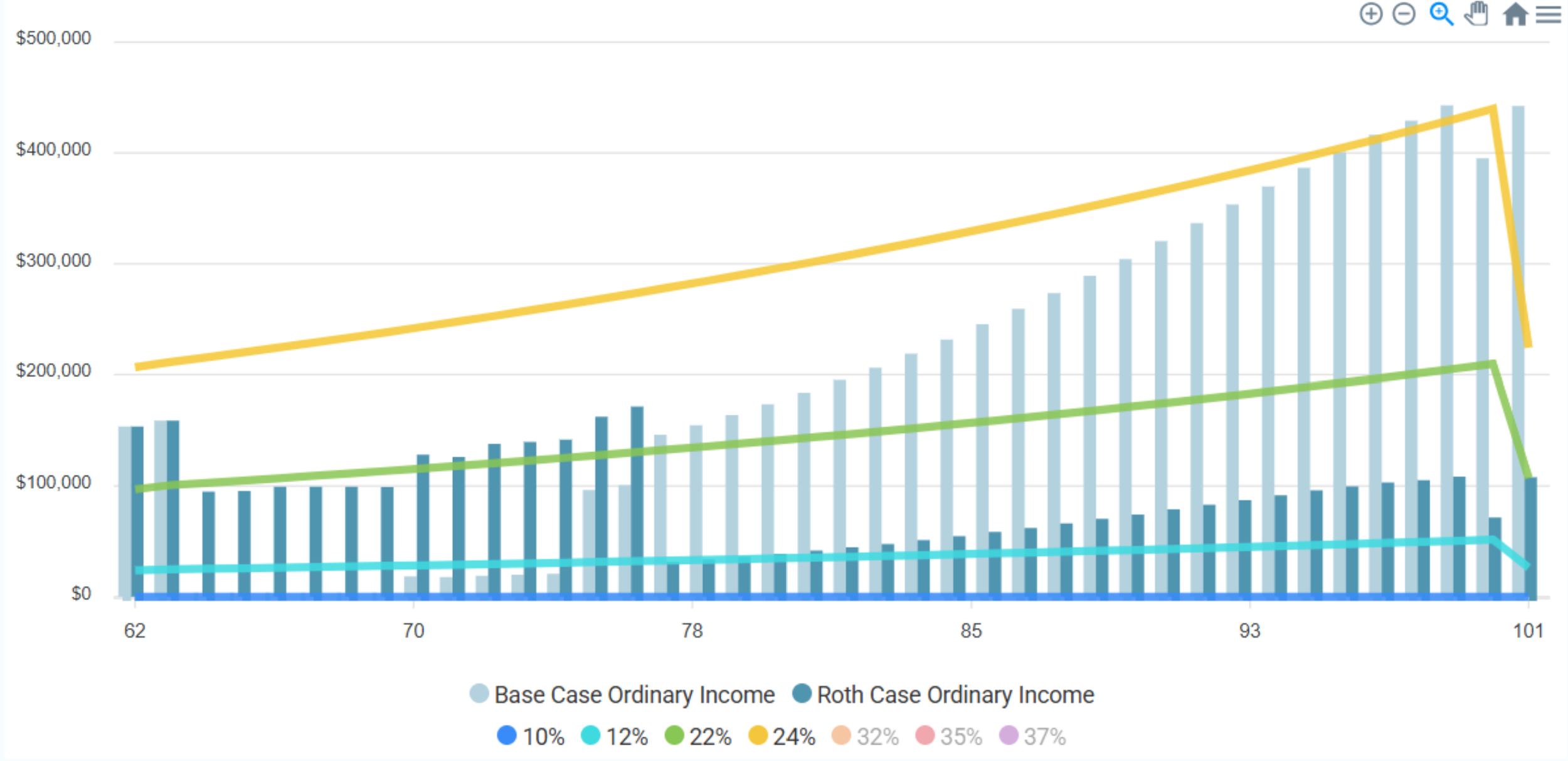

Strategic Roth Conversions to Minimize Lifetime Taxes

We analyze your current and future tax situation to identify optimal opportunities for converting traditional retirement accounts to Roth IRAs—helping you reduce your lifetime tax burden and create tax-free income in retirement.

As a fee-only fiduciary, we're paid only by our clients, not by product providers. Every conversion recommendation is made in your best interest, with full transparency.

Our approach combines multi-year tax projection modeling, coordination with your tax advisor, and strategic timing to maximize the long-term benefits. We monitor tax law changes and your personal circumstances to ensure conversions continue to make sense for your situation.

Our Roth conversion strategies include:

Multi-Year Tax Bracket Management

Medicare Premium (IRMAA) Optimization

Pre-Retirement Conversion Planning

Qualified Charitable Distribution (QCD) Coordination

Legacy & Estate Tax Planning

👉 Curious if Roth conversions could save you six figures in taxes?

Click here to schedule your Complimentary Tax Strategy Session.